Calculating Overtime for Public Safety Employees

The FLSA requires state and local governments using the 207(k) exemption to declare the work period for employees engaged in law enforcement and fire protection. The act does not require the same work period for all law enforcement and fire protection personnel. “Separate work periods can be declared for different employees or groups of employees.” 29 C.F.R. § 553.224(b). The work period chosen, however, need not coincide with the pay period for 207(k) employees.

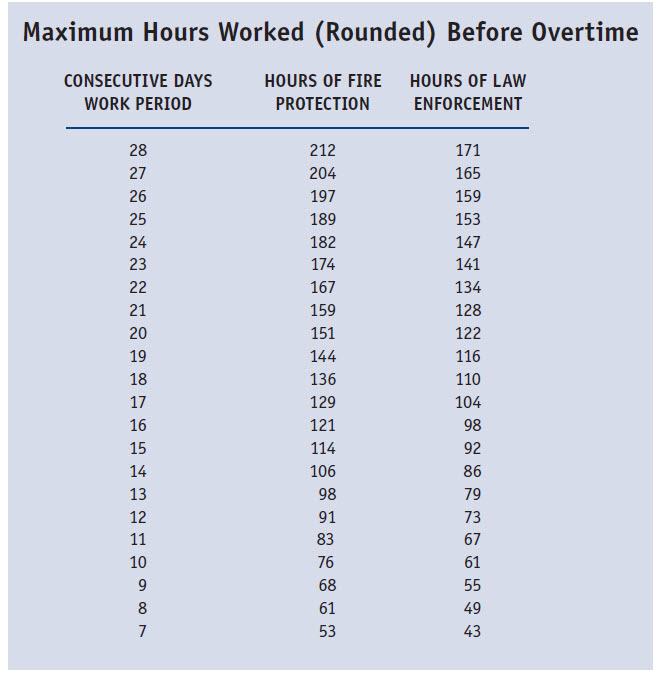

DOL regulation 29 C.F.R. § 553.230(c) established the table below to set forth the maximum hours for each work period after which law enforcement and fire protection employees are entitled to time-and-a-half overtime pay.

Section 207(k) allows “city and state employers to calculate the pay for non-exempt law enforcement and fire protection personnel based on a maximum 28-day period. It is improper to pay section 207(k) employees for an ‘average’ number of hours worked. For employees engaged in fire protection or law enforcement with a work period between 7 and 28 consecutive days, overtime for the excess hours is based on all hours over the number declared as the work period. A notation in the payroll records, however, must be made that shows the work period for each employee.” 29 C.F.R. § 516.2(a)(5).

The rules for computing a Section 207(k) employee’s regular rate are the same as those applied to all other nonexempt employees. When calculating overtime for 207(k) employees, the employer should not use the 40-hour workweek standard. Instead, the employer should look to the employee’s work period. Overtime pay is then calculated for hours worked in excess of the 207(k) maximum. The rules regulating the definitions of hours worked also apply. If employees are required to arrive at work early, the time is compensable. All time spent by law enforcement personnel in training sessions is counted as hours of work, but they are not compensated for overtime unless the total hours worked exceeds the maximum number of hours in the declared work period.

When off-duty police and firefighters are called back to work, they must be paid at least their regular hourly rate or at time and a half if they fall into an overtime situation. 29 C.F.R. § 553.221(c). Any on-call premium that is paid must be taken into consideration in determining the employee’s overtime rate. 29 C.F.R. § 553.233. A recent Kentucky case emphasized this point. The court of appeals held that any on-call premium provided as an incentive payment is akin to additional compensation (rather than in the nature of a bonus), and as such, the employee would be entitled to overtime calculated at time and a half on the incentive pay based on an hourly rate for the pay period. Kentucky Court of Appeals in City of Frankfort v. James Davenport, et al, No. 2005-CA-0000036-MR.

Volunteer firefighters who are paid by the call or by the hour when called to duty often are referred to by fire departments as “on-call firefighters.” On-call volunteer firefighters do not fall under this FLSA 207(k) exemption unless they are required to stay at the fire station or within a certain distance of the fire station.