PPACA Penalties

Cities with less than 50 employees meet the definition of a small business under the Patient Protection and Affordable Care Act (PPACA) and must notify workers of their health care options under state health exchanges. Employers with less than 50 FTE are exempt from the employer coverage requirements and applicable penalties under the act.

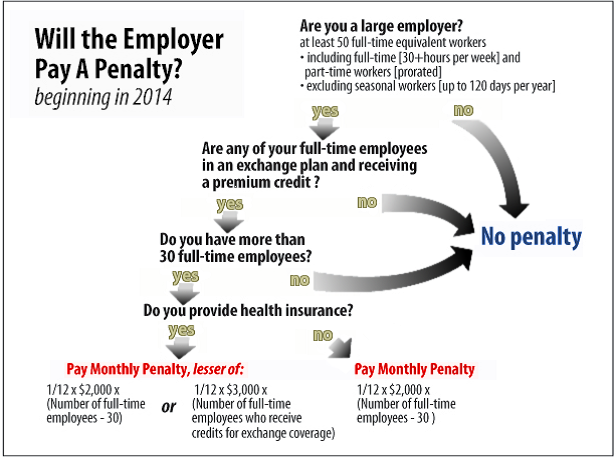

Regardless of whether a large employer offers coverage, it will only be potentially liable for a penalty under the act if at least one of its full-time employees obtains coverage through a health care exchange and qualifies for either a premium credit or a cost share reduction. To qualify for premium credits in an exchange, the employee must meet certain eligibility requirements, including that the employee’s required contribution for self-only health coverage (through the employer) exceeds 9.5 percent of the employees’ household income, or if the plan offered by the employer pays for less than 60 percent of covered expenses.

While hours worked by volunteers do not count toward the 50 full-time employee threshold, hours worked by part-time employees do count.

Employers are not required to offer coverage to ANY employee, but if the employer meets the definition of a large employer and does not meet minimum requirements of the PPACA, the employer will be penalized.

If a part-time employee obtains health insurance through an exchange, that will not trigger a penalty against their employer unless it is a large employer, and coverage was considered unaffordable.

If an employer does not offer insurance, but a full-time employee obtains insurance through a health care exchange, the penalty calculation against the employer is $2,000 per year multiplied by the number of full-time employees, excluding the first 30.

If an employer offers insurance, but full-time employees enter the exchange, the penalty is the lesser of (1) $3,000 annually for each employee entering the exchange, or (2) the penalty calculated for employers not offering insurance at all ($2,000 per year x the number of full-time employees, excluding the first 30).

Penalties are based on the number of full-time employees – not FTEs. FTEs are used only to determine if the employer qualifies as a large employer for the purposes of the PPACA.

The following chart from the Congressional Research Service (see references) shows how to determine if an employer will pay a penalty starting in January 2015. On July 17, 2013, Congress passed legislation delaying until January 2015 the employer requirements, employer penalties, and related reporting requirements specified under the PPACA.